It’s free, every week, in your inbox.

The reason, he said, was clear: Their search ranking is high because theyre an Amazon brand.

(We only analyzed products in that grid, ignoring modules that are strictly for advertising.)

Amazontold Congressin 2019 that its search results do not take into account whether a product is an Amazon-owned brand.

Sellers say it doesnt seem that way to them.

Who bears the cost are those entrepreneurs and small businesses that dont have the means to fight.

He said the practice has since stopped.

Thats not what shoppers expect.

By giving its brands top billing, Amazon is giving itself a significant leg up in sales.

The first three items on the search results page get 64 percent of clicks,according toone ex-Amazon-employee-turned-consultant.

Instead, Amazon labels the products featured from our brands.

Amazon refers to its own brands and brands developed by others that sell exclusively on Amazon as our brands.

They peddle everything from snack chips and vitamins to fashion and furniture.

Those are in addition to the estimatedhundredsof third-party brands that are exclusive to the site.

In short, Amazon was hogging the top spot.

Mumi has not been placed on the first page of our search results for packing cubes for months.

Their product will always show before yours, Mekler said.

One Mumi product has still been selling well despite the pandemic, she said: reusable pill pouches.

For now, there is no Amazon Basics pill pouch, and Mekler hopes there wont be anytime soon.

Were a small company, she said.

They would shut us down.

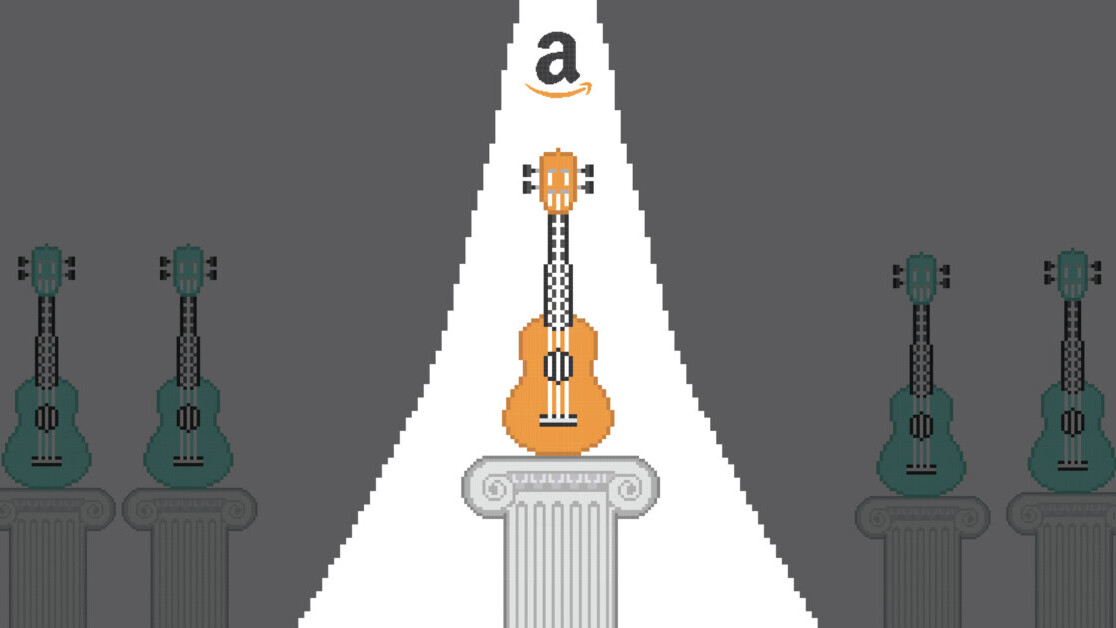

Some annotatedexamplesof popular searches we collected in January 2021.

Their whole livelihood relies on them.

It wasnt like they took some styling cues from it.

This was a knockoff, CEO Peter Dering said in an interview.

The smaller companyproduceda parody video that now has 4.6 million views on YouTube.

Within hours, Amazon changed the products name.

Still, he said he found the move highly distasteful.

The company does not provide a complete list.

Consumers would have an even harder time.

We found Amazon does not consistently label its brands and exclusives.

Large brick-and-mortar retailers also have house brands.

Costco has Kirkland Signature.

Target has Up&Up, among others.

Historically, he said, when large stores create brands they have been clearly affiliated with the store.

And Amazons search results are different from a store shelf.

This happened in 2015 when customer reviews for its newly launched Amazon Elements diapers included complaints aboutleaksand sagginess.

Amazonpulled the productsafter just seven weeks to make design improvements.

Consumers dont even know whats missing, she said.

Case in point: Brandon Fuhrmann, who runs the New York Amazon Seller Meetup.

He was considering expanding his kitchenware brand into a new throw in of dishware.

When that happened, we realized we couldnt even compete, he said.

He decided not to launch the product.

Rise of Amazon brands

Amazon has continually set its sights on dizzying growth.

It launched in 1995, with the goal of becoming Earths Biggest Bookstore.

Four years later, it declared its intention to become Earths Biggest Selection.

Were like, what are you talking about?

You guys sell books, he said.

What do you mean youre selling sporting goods?

Boyce took the plunge and his companys basketball sales took off on Amazon.

By 2018, third-party sellers like Boyce were responsible for 58 percent of physical goods sales on Amazon.

The volume created fortunes for small businesses across the world.

It also created a deep reliance on Amazon.

And these new third-party sellers had lots of competition, eventually from Amazon itself.

Boyce said Amazon started undercutting his business, selling the same sporting goodsSpalding basketballs, for examplefor less.

They figured Amazon couldnt undercut their prices if he and his brothers owned the brand.

They showed up at the top of search results.

Rally and Roar are exclusive to Amazon, labeled as our brands.

The company was moving in on his territory, again.

TJI Research counted 598 Amazon-exclusive brands in 2019.

Coresight Research said Amazon brand products on the sitetripledin the two years between 2018 and 2020 alone.

They sold the business.

Once a new house brand product was established, Meng said employees would turn off search seeding.

You turn off the ads and you lose organic rank within days, Boyce said.

Its pay to play.

Lots of companies are paying.

We found that inside the search results alone, 17 percent of products were paid listings.

(Including those would roughly double the ad percentage on the first results page.)

Amazon is thethird-largestseller of online advertising in the U.S., after Google and Facebook, and is growing fast.

It competes against a product from Amazon Commercial, among others.

It will appear on the first page for Patterson, but did not in repeated searches by The Markup.

The company now pays about $10,000 a month for advertising.

Our search ranking has improved dramatically, Patterson said.

But it still has a ways to go.

This article wasoriginally published on The Markupby Adrianne Jeffries and Leon Yin and was republished under theCreative Commons Attribution-NonCommercial-NoDerivativeslicense.