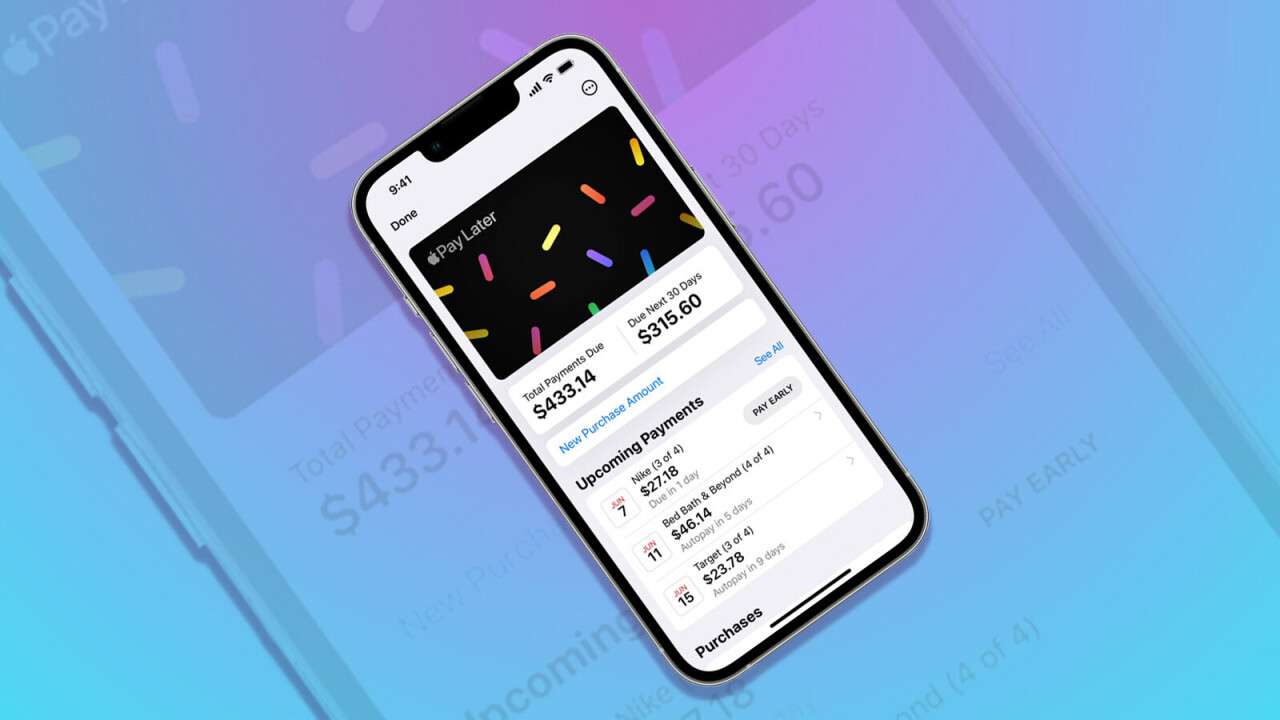

Apple has joined the thriving buy now, pay later industry, with a customized service calledApple Pay Later.

To qualify, however, Apple will first do asoft credit checkon users wanting to use the service.

The technology behemothclaimsit has designed the feature with users financial health in mind.

And consumers should be aware of the risks of using such a service.

Apple: the consumer darling

40% off TNW Conference!

And with an acute focus on customer experience, Apple has managed to foster a community of evangelists.

Theres no doubt the company is aconsumer darling.

Pay Later enhances this customer-centric experience further.

Its one more way users can integrate the tools they need within a single ecosystem.

Whats in it for Apple?

Apple stands to make financial gains through Pay Later, thereby adding to its bottom line.

One 2021 survey found that about 26% ofregular online shoppersin Australia used buy now, pay later services.

As Apples customers increasingly start to use the Pay Later service, it will gain from merchant fees.

These are fees which retailers pay Apple in exchange for being able to offer customers Apple Pay.

This strategic partnership has helped Apple gain strong footing in the world of consumer finance.

They can condition consumers to make purchases without feeling the pain of parting with cold, hard cash.

From a consumer psychology perspective, these services encourages immediate gratification and put younger people on the consumption treadmill.

In other words, they may continually spend more money on purchases than they can actually afford.

A focus on consumerist behavior can also trigger an ownership effect.

Apples technology-driven and consumer-centric marketing gives it an edge over other buy now, pay later schemes.

It claims the service is designed with consumers financial health in mind.