China is making promising progress with testing its digital yuan currency.

For those eligible, there is a straightforward app to download which gives them a wallet.

Using this to make purchases in thousands of participating stores, they receive discounts.

However, this blockchainis permissioned, meaning the Peoples Bank decides who can use it.

It’s free, every week, in your inbox.

Yet a digital yuan raises profound questions about global financial stability.

The question for the worlds other major economies is how to respond.

Advantages of digital currencies

The digital yuan alreadyhas the statusof legal tender.

The digital yuan bypasses the need for these banks.

Unlike cryptocurrencies such as bitcoin, the currency is also backed by a government.

Three dangers

Lots of central banks have been looking at developing digital currencies.

Some such as Japan and South Korea arenot far behindthe Chinese.

The EUis signallingthat a digital eurocould befour or five years away.

For the laggards, there are several dangers.

The first is around international payments.

Most transactions between different currencies currently use the US dollar as an intermediary, viathe SWIFTinternational banking protocol.

In 2019, for example, China aloneexported goodsworth $134 billion (96 billion).

Transactions using digital yuan wont need SWIFT or the dollar, with implications for dollar usage in international trade.

A second danger is that if central banks dont meet the demand for digital money, market forces will.

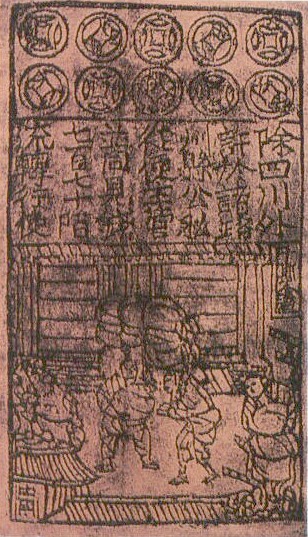

Paper moneywas inventedin China during the Song Dynasty in the 11th century.

But it is fast becoming redundant.

Contactless credit cards have become ubiquitous during the pandemic.

Digital money is better still as it costs less to use.

The digital yuan is happening amidheightened tensionsbetween China and the US and Europe.