The bill does not seek to impose a blanket ban on all Russian cryptocurrency transactions.

But is it even necessary?

It’s free, every week, in your inbox.

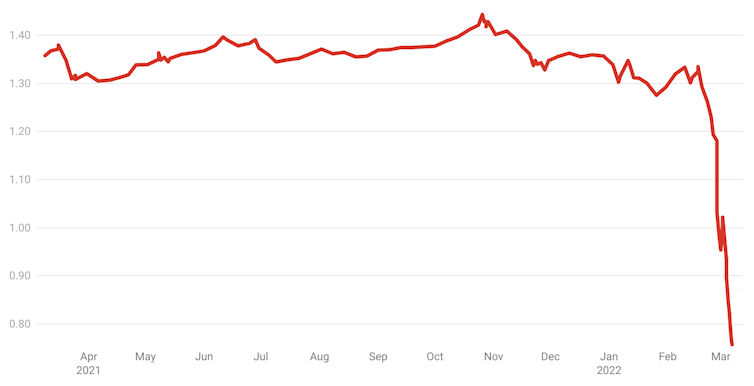

Rubles falling value

Our first graph below shows why ordinary Russians have good reasons to buy cryptocurrency.

At the time of publication, $US1 was worth about 109 rubles.

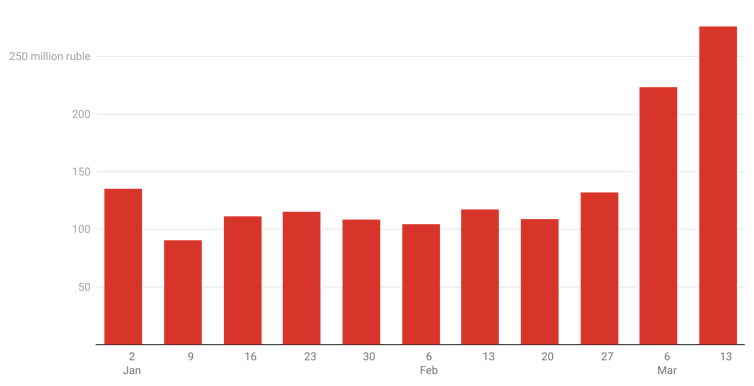

This data comes fromCoin Dance, a leading Bitcoin statistics and services company.

Thats a 100% rise.

In global terms, this is still a tiny percentage of the money going into Bitcoin.

So the Bitcoin-ruble trade represents less than 0.14% of the total.

(The Russian population is about 144 million.)

This compares to the average value of American transactions being $US2,198 at the same time.

With fewer buyers and sellers, it is harder.

These statistics suggest anyone wishing to trade large volumes of Bitcoin against the ruble will have difficulties.

There is little argument against the strategy of using economic sanctions to combat recalcitrant regimes.

Other than direct military intervention, there are few other meaningful weapons available.

But a detailed analysis of any proposed sanction beforehand is needed to overestimate its likely effectiveness.