The market seems to have benefited from the public having time on their hands during pandemic lockdowns.

Alongside this has been an explosive rise in the value of stablecoins like tether, USDC and Binance USD.

Like other cryptocurrencies, stablecoins move around on the same online ledger technology known as blockchains.

A substantial proportion of buying and selling of crypto is done using stablecoins.

So whats the problem and what can be done about it?

It’s free, every week, in your inbox.

Binance USD is owned by Binance, another crypto exchange, which is headquartered in the Cayman Islands.

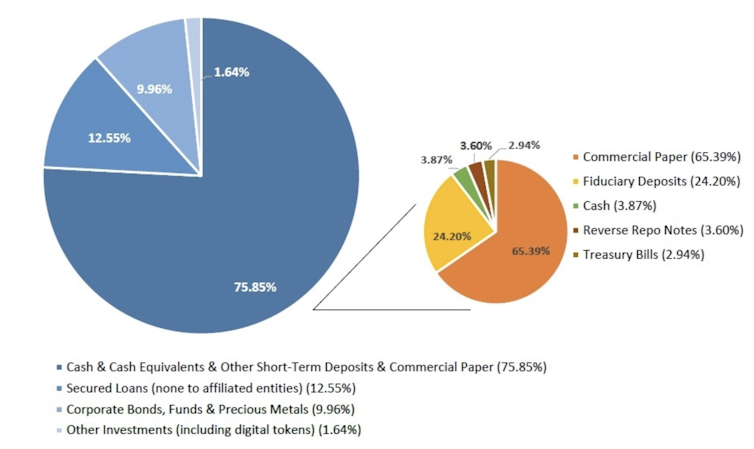

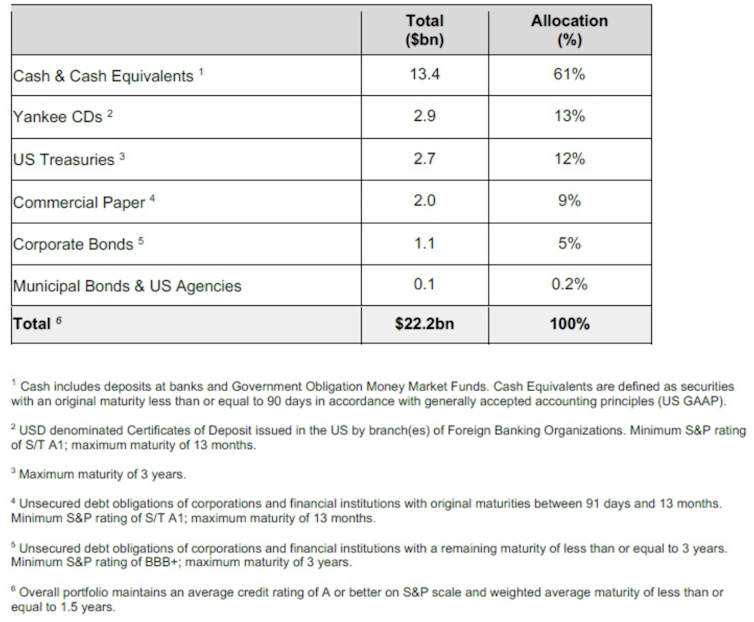

These 1:1 ratios are not automatic.

USDC has 61% as of May 2021, so both are someway short of 100%.

So what could derail the machine?

The only element that could challenge this abundance of money is inflation.

In this case, central banks can let inflation run at 3%-4% levels.

But if theeconomy overheats, it could lead to an explosive situation of high inflation and economic recession.

Lots of money would be moved out of risky assets and bonds into safer havens like the US dollar.

The value of those riskier assets, including commercial paper, would fall off a cliff.

This would seriously damage the value of the reserves of stablecoin providers.

This could drag down the crypto market and potentially the financial system as a whole.

Overall, however, it seems that the response from the regulators is still tentative.

The Presidents Working Group report recommended stablecoin providers be forced to become banks,but delegatedany decisions to Congress.

It is possible that the risks will reduce as more stablecoins arrive on the market.

Facebook/Meta haswell publicized plansfor a stablecoin called Diem, for instance.

Perhaps the systemic risks of stablecoins will be reduced in a more diversified market.

For now, we wait and see.

The speed at which this unnerving risk has emerged is certainly a concern.