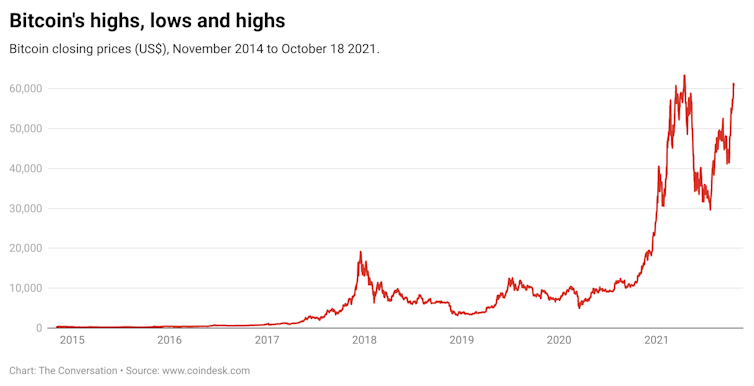

The Bitcoin bulls are racing again.

A year ago the cryptocurrency was valued at less than US$12,000.

So what is an ETF, and why does this matter to the value of Bitcoin?

How does an ETF work?

An exchange-traded fund is an investment fund, comprising a pool of assets, traded on a stock exchange.

The general attraction is that an ETF offers individual investors the benefits of diversification, protection, and liquidity.

It’s free, every week, in your inbox.

Suppose, for example, you want to invest $100,000 in commercial property.

Heres where a funds manager with an ETF can help.

The manager buys a number of office buildings and shopping centers across a range of locations.

Suppose these assets cost $100 million.

These are bundled into a fund with 1,000 units sold for $100,000 each.

Its like buying a share in a company.

It allows you, the investor, to avoid the exposure that comes from buying a single asset.

Instead, you get a share of a diversified portfolio.

If the value of the portfolio rises, so does the value of your unit.

An ETF is also regulated.

This protects you from some of the risks (such as fraud) that come from buying assets directly.

These funds can be either passively or actively managed.

What has this got to do with Bitcoin?

A Bitcoin-based ETF is seen as something that will entice more investors to gamble on cryptocurrency.

Buying Bitcoin or other cryptocurrencies directly can be fraught.

Forget your private key (the equivalent of a password or PIN) and you loseit all.

There is no friendly local bank manager who can retrieve or reset a password or make good your loss.

Scams are also on the rise.

In the US alone, more than81,000 cases of fraudwere reported in 2020.

An indirect gamble is still a gamble.

Indeed anETF of Bitcoin futuresisnt even indirect ownership of a pool of bitcoins.

Its a pool of contracts about bets on the future price of the cryptocurrency.

The more complex the financial instruments become, the more dangerous they may be.

Last weekhe effectively warnedthat cryptocurrencies are a speculative bubble.

This is a view shared by mosteconomistsandbusiness leaders.

As with all bubbles, some will make fortunes, but many will lose.