Thats more than double the previous six months and the strongest half year since the first half of 2007.

Yet the lure of private equity is not the only explanation for companies walking away from thestock market.

So whats going on, and are they doing the right thing?

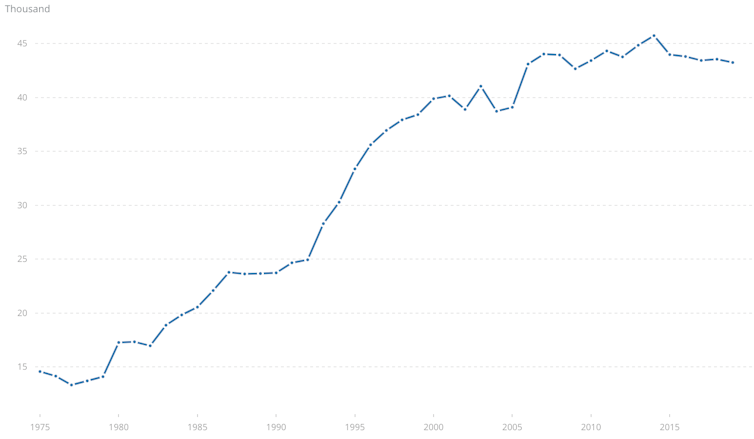

The current rate of money-supply expansion isfaster thanthe growthof economies.

With lending rates so low, all this money is chasing investments.

A stock-market listing begins to seem tedious when you could just borrow money very cheaply instead.

The second attraction with being private is regulation.

These constraintshave motivatedmany a company to skip public scrutiny by choosing to be private instead.

Another problem with public markets is how illogical they have become.

Witness GameStop and other shares going through the roof earlier this year thanks to the Reddit groupWallStreetBets.

Equally, tweets and memes can send valuations soaring or sinking.

No wonder many company boards would rather keep away from such a volatile environment.

Do you want Tesla to accept Doge?

Elon Musk (@elonmusk)May 11, 2021

Is it worth it?

He had got the business into a stronger position that he felt would be recognized by the markets.

Neither is an improvement in a companys market sentiment the only argument for staying listed.

But again, delisting isnt the only way around this problem.

One other potential medium-term advantage to being listed relates to regulation.

In this sense, the allure of going private might turn out to be fools gold.